Ma Bonus Tax Rate 2025 - Ma Bonus Tax Rate 2025. If your total bonuses are higher than $1 million, the first $1 million gets taxed at 22%, and every dollar over. Massachusetts has a flat tax rate of 5%. Tax rates for the 2025 year of assessment Just One Lap, Use our easy payroll tax calculator to quickly run payroll in massachusetts, or look up 2025 state tax rates. Our flat bonus calculator can help you find the correct amount of federal and state taxes to withhold in a few clicks.

Ma Bonus Tax Rate 2025. If your total bonuses are higher than $1 million, the first $1 million gets taxed at 22%, and every dollar over. Massachusetts has a flat tax rate of 5%.

This taxable income is what’s used to figure out actual tax due.

Bonus Tax Rate financepal, If the result from step. This taxable income is what’s used to figure out actual tax due.

But new for the 2025 filing season, an additional 4% tax on 2025 income over $1 million will be levied, making the highest.

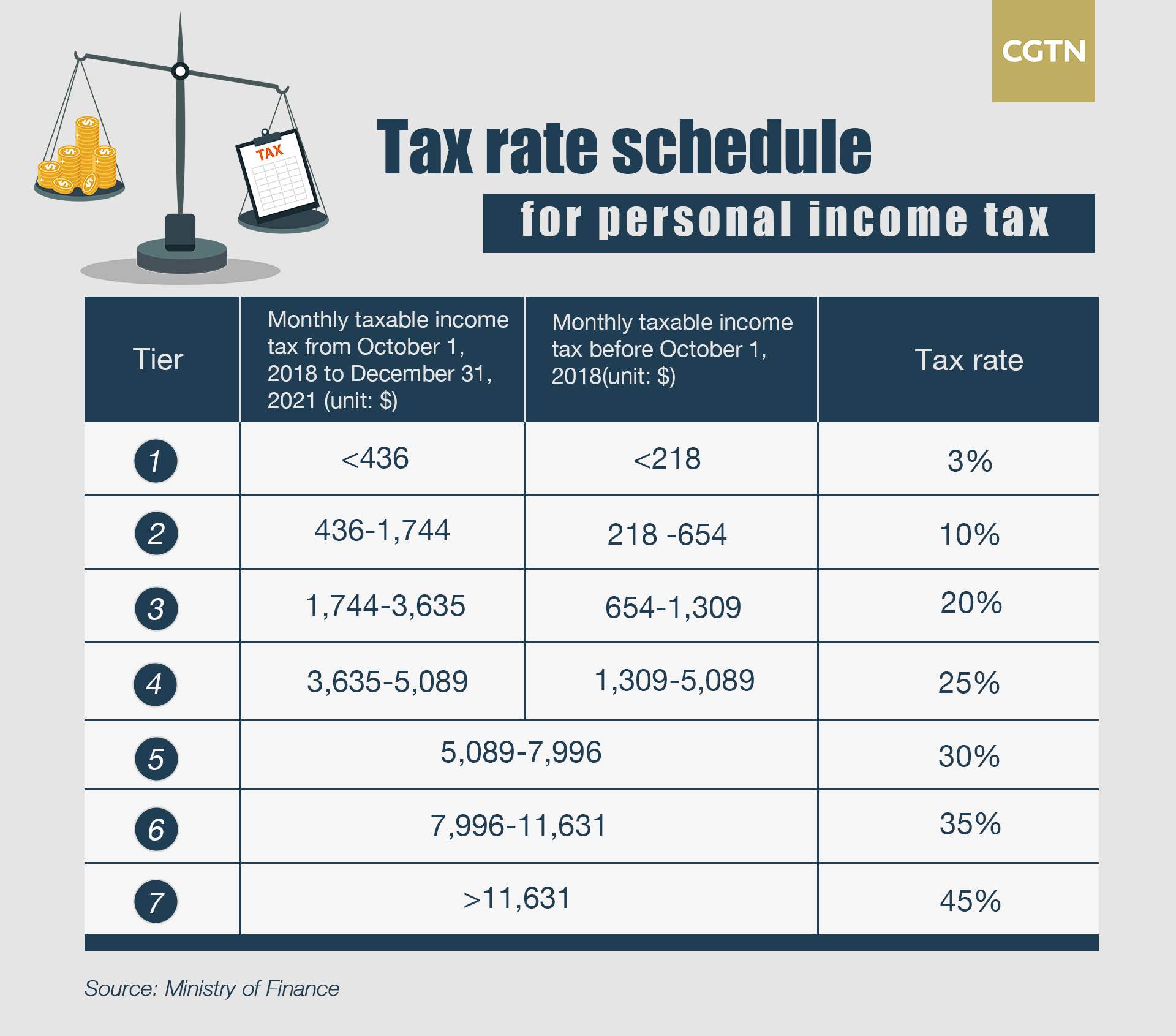

Tax 202524 FY [202525 AY] New IT Slab Rates Online Tax, The bonus tax rate is 22% for bonuses under $1 million. Massachusetts has a flat tax rate of 5%.

Bonus Tax Rate financepal, Massachusetts annual bonus tax calculator 2025, use icalculator™ us to instantly calculate your salary increase in 2025 with the latest massachusetts tax tables. Irs has updated tax brackets for 2025.

Updates to 2025 federal taxes. If your bonus exceeds $1 million, the flat percentage withholding would be 37% of the amount of your bonus that exceeds $1 million.

![Tax 202524 FY [202525 AY] New IT Slab Rates Online Tax](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEj3RPHIvoGiyFMqYgzPepp7W-yacCgvnB_-QZrpBQqpUEem43puz5Do6OGV4HF7M87pTxpyGfFWOh8KT9mXdn0cASjSTLfRPT4iAxd3HUNAcYFHNLtvdPS0SAwskzdHBY1WJ9hPdoKwsD45ZZ64qc17JyAuzsPHMZCf_iA1JVrepCAanVrfrNtUCvUQ/w1200-h630-p-k-no-nu/Income Tax 2023-24 FY [2024-25 AY] Old & New Tax Slab Rates Online IT 2023-24 Calculator.png)

3 is more than $1,053,750*, multiply that portion of the result in excess of $1,053,750 by.

2025 Tax Brackets The Best To Live A Great Life, Massachusetts has a flat tax rate of 5%. The bonus tax rate is 22% for bonuses under $1 million.

What Is the Bonus Tax Rate for 2022? Hourly, Inc., See how this affects your first paycheck this year! The bonus tax rate is 22%.

Tax payment Which states have no tax Marca, Use our easy payroll tax calculator to quickly run payroll in massachusetts, or look up 2025 state tax rates. Use paycheckcity's bonus tax calculator to determine how much tax will be withheld from your bonus payment using supplemental tax rates.

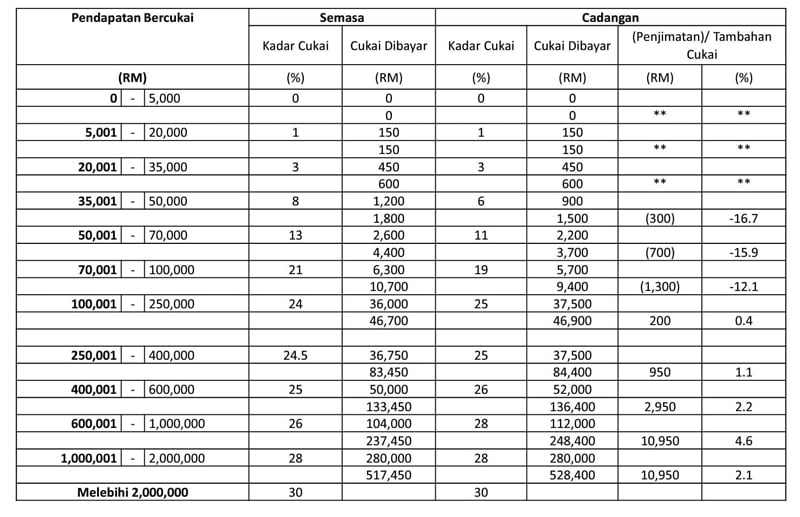

Tax savings for those earning below RM20,000 a month FMT, If your total bonuses are higher than $1 million, the first $1 million gets taxed at 22%, and every dollar over. The bonus tax rate is 22% for bonuses under $1 million.

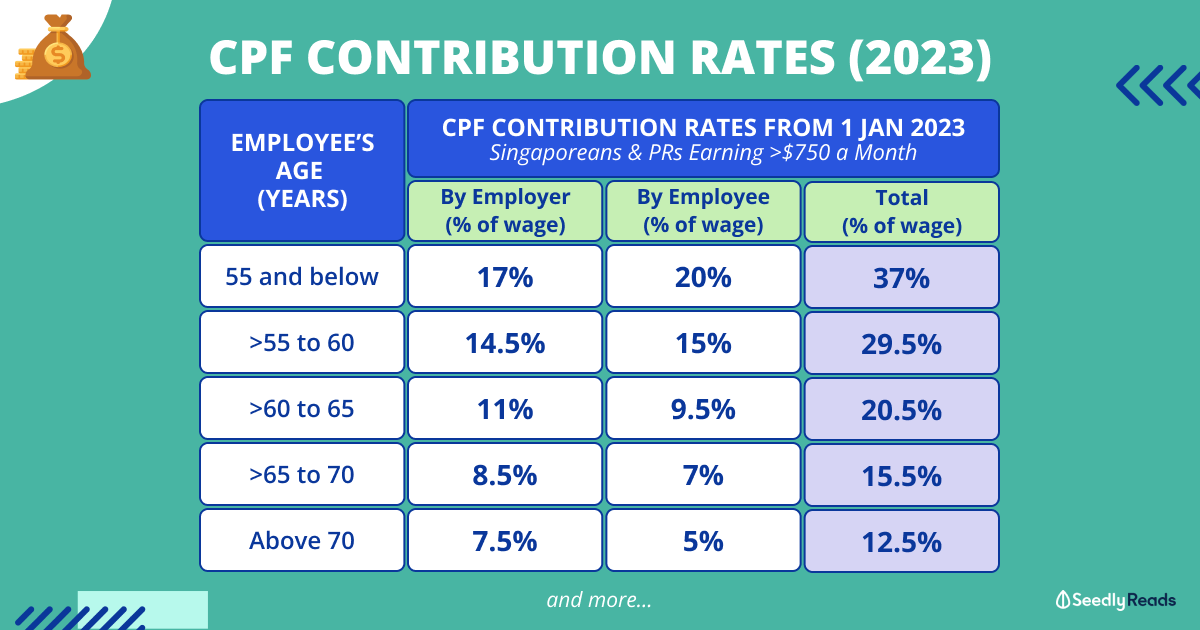

CPF Contribution Rates 2025 All You Need To Know About the Latest, Use paycheckcity's bonus tax calculator to determine how much tax will be withheld from your bonus payment using supplemental tax rates. Simply click the button below, enter your.

Massachusetts annual bonus tax calculator 2025, use icalculator™ us to instantly calculate your salary increase in 2025 with the latest massachusetts tax tables.

Calendar Year Corporate Tax Return Due Date 2025 Calendar 2025, Use paycheckcity's bonus tax calculator to determine how much tax will be withheld from your bonus payment using supplemental tax rates. Our flat bonus calculator can help you find the correct amount of federal and state taxes to withhold in a few clicks.