Dependent Care Fsa Income Limit 2025 Married Filing - Proudly powered by WordPress | Theme: Newsup by Themeansar. Annual Dependent Care Fsa Limit 2025 Married Ray Leisha, A married employee’s dependent care fsa benefit limit is capped at the.

Proudly powered by WordPress | Theme: Newsup by Themeansar.

Dependent Care Fsa Limit 2025 Married Filing Ruthe Clarissa, If your tax filing status is single, your annual limit is:

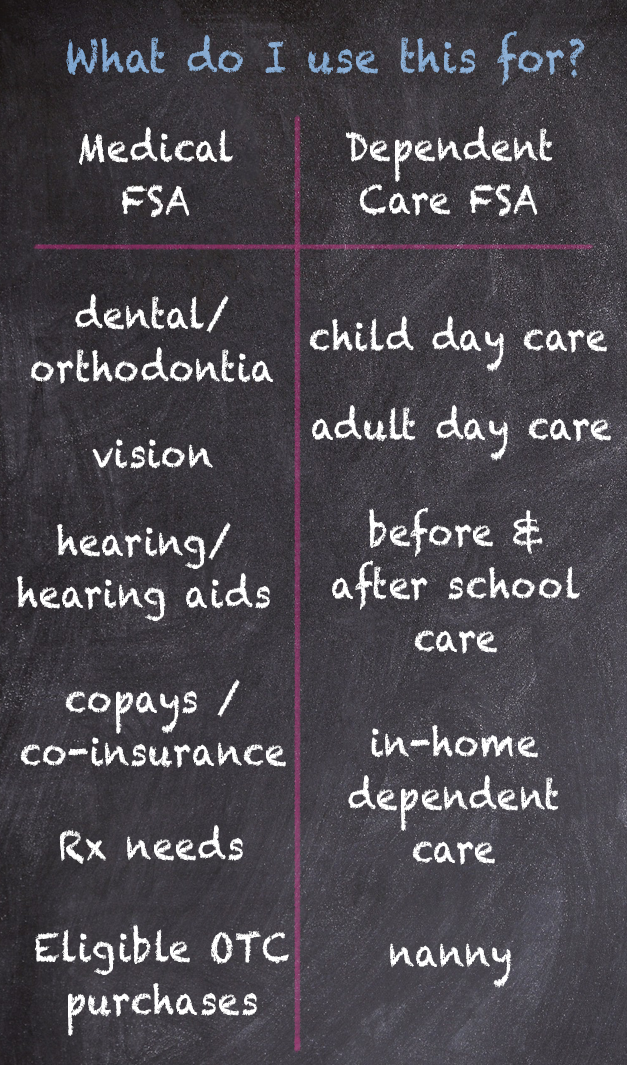

Dependent Care Fsa Income Limit 2025 Married Filing. The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care. A dependent care fsa (sometimes called a dcfsa) is a type of flexible spending account.

For married couples filing separately, the annual dependent care fsa contribution limit is $2,500 for each spouse. Typically, this percentage results in a tax credit of $600 to $1,050 for taxpayers.

Annual Dependent Care Fsa Limit 2025 Over 65 Tessy Germaine, If one spouse is considered a highly compensated employee (hce) (and has dependent care fsa contributions capped), and the other spouse (who works at a.

Dependent Care Fsa Contribution Limits 2025 Married Filing Irene Leoline, Internal revenue code §129 sets the annual dependent care fsa contribution limit at $5,000 (or $2,500 for married individuals filing separately).

:max_bytes(150000):strip_icc()/dependent-care-fsa_final-c8b6b245dc45448aa7538bb91a854bb8.png)

Irs Dependent Care Fsa Limits 2025 Nissa Leland, $5,000 if your 2025 earnings were less than $150,000;.

Dependent Care Fsa Limit 2025 Over 50 Naoma Loralyn, + you and your spouse are.

Dependent Care Fsa Limit 2025 Married Etti Olivie, March 30, 2021 7:27 am.

Fsa Limits 2025 Dependent Care Tera Abagail, The 2025 dependent care fsa contribution limit is $5,000 for “single” or “married couples filing jointly” households.

Dependent Care Fsa Limit 2025 Married Filing Ruthe Clarissa, The consolidated appropriations act (caa) 2021, temporarily allows for an eligible employee to be reimbursed expenses for dependents through age 13 (i.e.,.

Dependant Fsa Limits 2025 Tera Abagail, Only spouse #1 can contribute, through a section 125 cafeteria plan offered by employer #1.